3 Little-Known Ways To Access Your 401(k) Penalty-Free Before 59 ½

If you’re part of the FI/RE community and are thinking about retiring early like I am, you might be wondering why you should contribute to your 401(k) if you won’t be able to access those funds by the time you retire. In most cases that’s true, and the only penalty-free way to withdraw from your 401(k) is to wait until age 59 ½. However, there are 3 little-known ways to work around that age restriction that give you access to your 401(k) accounts early!

Rule of 55

If you withdraw from your 401(k) before age 59 ½, there’s usually a penalty of 10% on the distribution amount. However, according to the Rule of 55, if you get laid off, fired, or quit between the ages of 55 and 59 ½, you can pull money out of your 401(k) penalty-free!

So what’s the catch? Well first of all, you’re limited to only withdrawing from that particular employer’s 401(k) account. 401(k)s from previous employers are ineligible from the Rule of 55. However, to get around that limitation, you can roll over your previous 401(k)s into your most recent employer’s 401(k)!

The hard part isn’t necessarily the rollover itself; the difficulty is likely going to be whether your most recent employer accepts rollovers whatsoever. If they don’t, you’re out of luck and have to wait until 59 ½ to access your previous 401(k)s penalty-free.

Note that like any 401(k) withdrawal, you are still subject to ordinary income taxes. The Rule of 55 just exempts you from the typical 10% early withdrawal penalty.

Substantially Equal Periodic Payment (SEPP)

The next workaround to withdrawing from your 401(k) before age 59 ½ is called a Substantially Equal Periodic Payment (SEPP) plan. The SEPP program is available to any type of retirement account, like a 401(k), except your current employer’s. The program allows you to take pre-determined and relatively equal withdrawals annually for a minimum of 5 years or until you reach age 59 ½, whichever comes later. So if you begin the SEPP at age 58, you can’t stop it until you reach 63. But if you started at age 50, it ends at age 59 ½. The methods used to calculate the amount you withdraw every year are complicated and pre-determined for you, so consult with a financial advisor on details.

If you quit the plan, you will face hefty penalties, including all withdrawal penalties you avoided in the years you participated in the SEPP plus interest! So be very careful of using a SEPP as it can have dramatic financial downsides if not planned properly. Again, consult with a financial advisor before committing to this program.

Roth IRA Conversion Ladder

As you might already know, a Roth IRA is a type of retirement account that is funded with post-tax dollars and its earnings grow tax-free. Similar to a 401(k), if you withdraw from your Roth IRA before age 59 ½, your earnings are subject to a 10% penalty. Direct contributions to a Roth IRA can always be withdrawn penalty-free at any age. However, indirect contributions, like when you convert a traditional 401(k), are subject to a waiting period called the 5-year rule. After the 5-year waiting period ends, only then are your converted dollars eligible for penalty-free withdrawals. For more details on the waiting period, read this article.

Knowing those fundamentals is key to a Roth IRA conversion ladder. Here’s how it works:

Roll over a portion of a 401(k) into your Roth IRA

Wait 5 years (to satisfy the 5-year rule)

Withdraw your converted funds from (1) tax-free

Note that because your traditional 401(k) was funded with pre-tax dollars, those dollars are taxed the year you roll them into your Roth IRA. But when you withdraw them after satisfying the 5-year rule, you withdraw them penalty and tax-free, regardless of your age!

That process is pretty straightforward, but you probably don’t want to rollover the entire 401(k) balance into your Roth IRA all at once. Otherwise, you’ll likely be responsible for quite a hefty tax bill! The Roth IRA conversion ladder is not about a single conversion; instead, it’s about strategically converting 401(k) dollars annually over a set period of time. Ideally, you know exactly the year you plan to retire early and you start your conversion ladder at least 5 years before then (so you satisfy the 5-year rule the year you retire early).

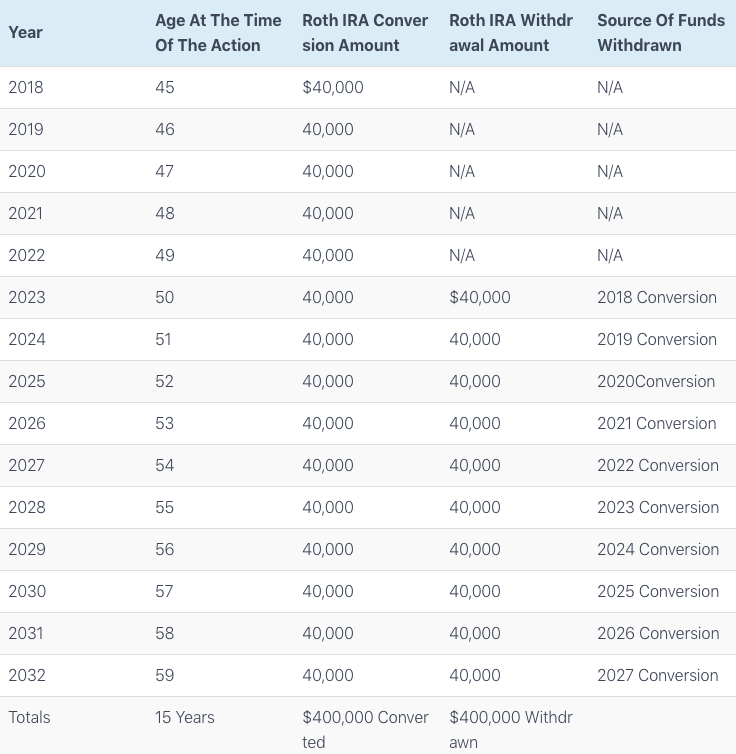

ChooseFI has a nice table illustrating what the Roth IRA conversion ladder might look like:

In this example, you see that this individual converts $40K every year starting at age 45 and is able to access those converted dollars starting at age 50. By the time they reach age 54, they’ve converted $400K. At the end of the ladder, they were able to withdraw all $400K converted dollars penalty and tax-free!

Note: I believe there’s an error in ChooseFI’s table in that the Roth IRA Conversion Amount was supposed to stop at age 55. The total converted dollars is correct since they intended to cap the amount at $400K. It doesn’t make sense to convert if you’re 55+ given you can access your funds directly from the 401(k) by age 59 ½ without the extra overhead.

If you’re interested in hearing another perspective on a conversion ladder with a tax-efficient mindset, check out Road To Fire's blog post.

Tax Considerations

If you plan to use any of these methods to access your 401(k) dollars penalty-free, be sure to know your tax situation. Ideally, you want to withdraw in the years when your income is low, not when your income is high. If you’re going to have a higher income when you retire, there’s more incentive to withdraw now when your income tax bracket is lower. For most, incomes are much lower when they retire. So if you can wait till 59 ½ to access your 401(k)s, it probably makes the most sense to do so. For one, you won’t have to go through the paperwork to follow-through on any of these loopholes.

Conclusion

Personally, I am still maxing out all my retirement accounts every year, and I advocate you to do the same if your budget allows. While I am not planning on relying on either the Rule of 55 or the SEPP exemption to access my 401(k) accounts when I retire early, they certainly give me more peace of mind knowing I have a backup option should I need to withdraw from them sooner than expected.

As far as using the Roth IRA conversion ladder goes, it’s certainly appealing. However, I currently plan to leave my pre-tax retirement accounts alone and only access them at normal retirement age. I’m confident in my ability to reach my FIRE number and live comfortably without relying on my retirement accounts.

For those of you in the FIRE community, what are your thoughts? Are you contributing to your retirement accounts? Do any of you plan to use any of these loopholes? Share your thoughts in the comment section below, and thanks for reading!