How To Set Up a Backdoor Roth IRA With Fidelity

Editor’s Note: This guide was originally published in 2021 and has been updated in January 2025 for accuracy.

In this step-by-step guide, I will walk through the steps to set up a Backdoor Roth IRA with Fidelity. If you don’t know the benefits of a Roth IRA, check out my post on Roth IRA vs 401(k) first. After reading it, you’ll know that performing a Backdoor IRA conversion is only useful if your 2025 income is above $150K (single) or $236K (married filing jointly).

Before proceeding, I must advise you to seek a professional tax/financial advisor since there may be some hidden consequences of performing a Backdoor IRA. For example, read about the pro-rata rule and how all your IRAs are treated as one aggregate account, which may trigger some unintentional tax consequences. If you don’t have any tax-deferred money in any existing IRAs or if you simply don’t have any IRAs at all, setting up a Backdoor IRA should be relatively straightforward.

There are several ways to set up a Backdoor IRA. But for the sake of simplicity, I will focus only on converting a Traditional IRA to a Roth IRA using cash (instead of assets).

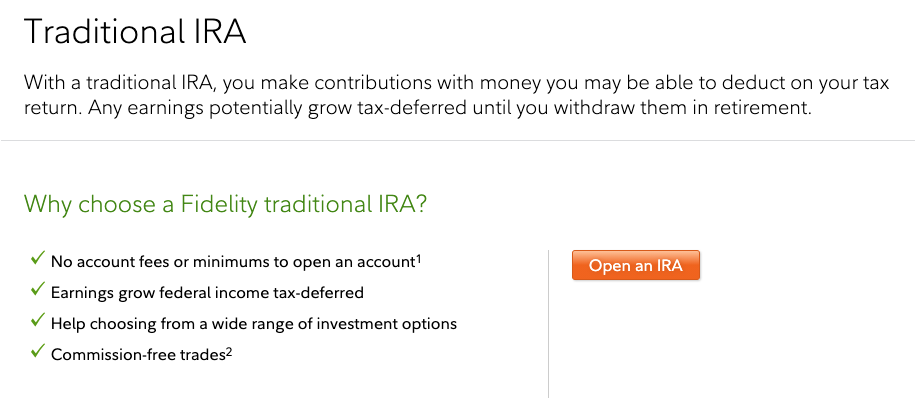

1) Open a Traditional IRA with Fidelity. Go to https://www.fidelity.com/retirement-ira/traditional-ira and follow their step-by-step guide.

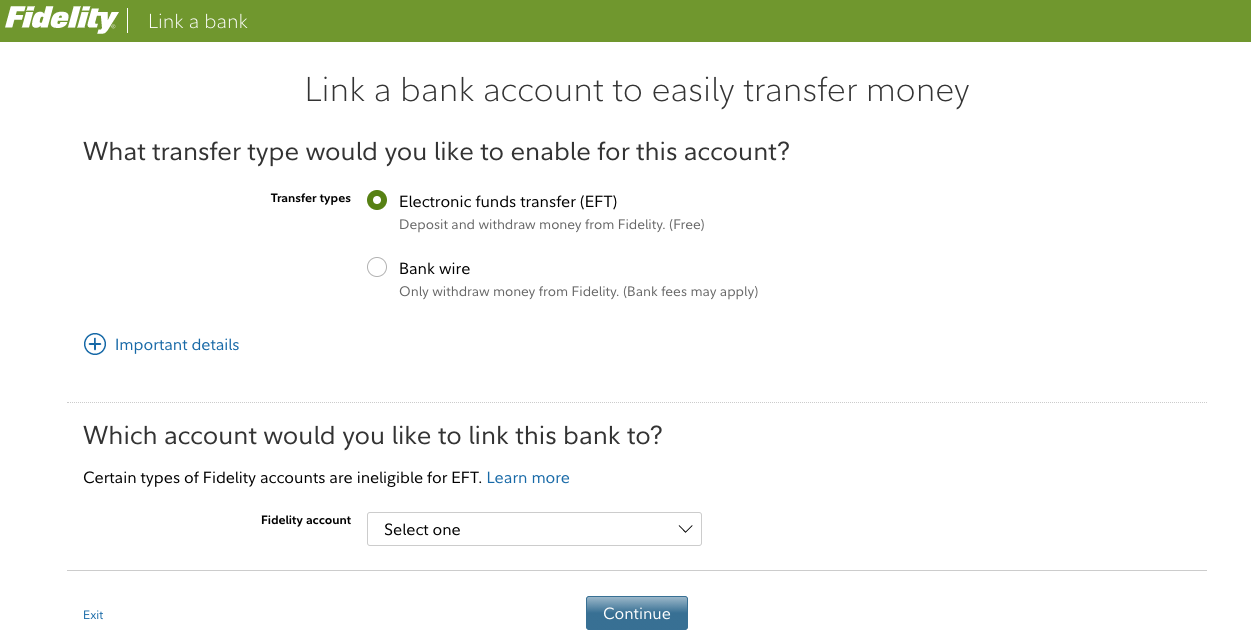

2) Link a bank account. Since this may be your first time using Fidelity, you may need to “link a new bank” to your account before you can set up a one-time deposit.

a) Go to https://digital.fidelity.com/ftgw/digital/bank-setup.

b) Select which transfer type you’d like to use. I usually use electronic funds transfer (EFT) since banks usually have $0 fees. However, there’s a 1-3 business day settlement period for your cash to settle in your Traditional IRA. Wire transfers are faster but banks may charge a fee.

c) Select your newly-created Traditional IRA account to link your bank account to.

d) Fill out the remaining fields as requested by Fidelity.

3) Fund your Traditional IRA. After you finish linking a bank account to your Traditional IRA, now it's time to make your first contribution.

a) Go to https://digital.fidelity.com/ftgw/digital/transfer/.

b) Select which account to move money from. If you just linked a new bank account in Step 2, you’ll likely want to select that bank account. If you’re an existing Fidelity customer, it’s also possible to select another investment account like an individual Fidelity brokerage account that contains cash.

c) Next, select your Traditional IRA as the account the money should be transferred to. As I mentioned previously, you’ll notice that the estimated delivery time of the cash deposit is 1-3 business days.

d) For “Frequency,” select “Just once.”

e) Enter a “Date” you wish to transfer money from your bank into your account.

f) For “Amount,” you may contribute up to $7,000. If you’re 50 or older, you can contribute up to $8,000. Note: These limits are valid as of 2025.

4) Cash settlement. Wait 1-3 business days for your funds to settle. Personally, I prefer a “clean” conversion from a Traditional IRA to a Roth IRA. So every year that I perform a Backdoor IRA conversion, I wait for my funds in my Traditional IRA and not invest a single dollar. I only invest after the Backdoor IRA conversion.

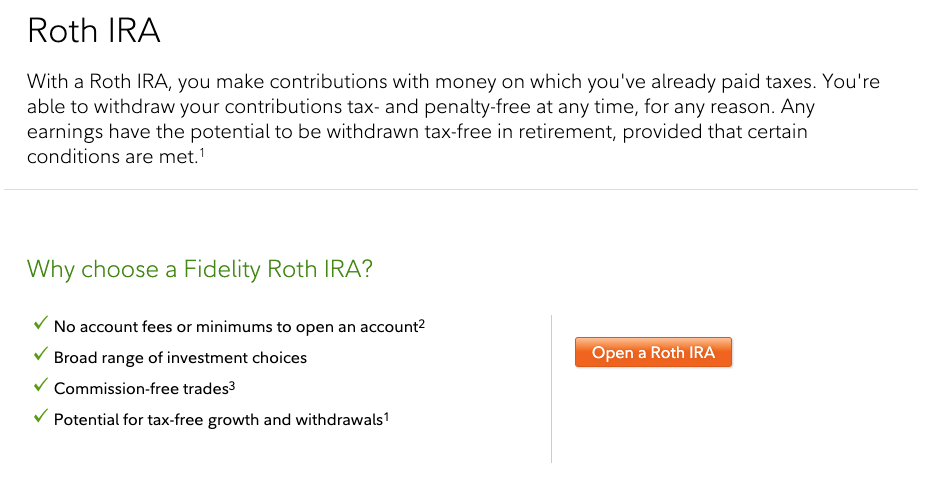

5) Open a Roth IRA. Similar to Step 1, but open a Roth IRA instead. Don’t fund it. We’re doing a Backdoor IRA conversion, so the funds will come from the Traditional IRA at a later step.

a) Go to https://www.fidelity.com/retirement-ira/roth-ira and follow their step-by-step guide.

6) Backdoor IRA conversion. To complete this guide, we need to convert your Traditional IRA to a Roth IRA account. Since the time it takes for your funds to settle varies, attempt this step every day after waiting at least 1 business day since your initial deposit (Step 3).

a) Go to https://digital.fidelity.com/ftgw/digital/transfer/.

b) Select your Traditional IRA to move money from.

c) Select your Roth IRA from the dropdown and continue.

7) Congratulations! That’s it. You’ve successfully set up a Backdoor IRA! Now you can start investing your contributions and watch your earnings grow tax-free!

If you’re interested in learning about another way to grow even more of your investments tax-free, read my blog post on the mega backdoor Roth! I’ve also created a guide on how to setup automatic investing, as well.

Here are some of my other popular guides:

Mega Backdoor Roth: Step-by-step guide

Automatic Investing: Set up your investments automatically (out of sight, out of mind!)

Real Estate Evaluation: Use what I use to evaluate rental properties!

Disclaimers

All screenshots were taken in 2020 from Fidelity.com and may be subject to change.

Backdoor IRA conversions are sanctioned by the IRS as of 2025, but they may close them off in the future.

Roth IRA income and contribution limits may differ in future years.

This is not advice. Reach out to a tax/financial advisor for professional assistance.