Ways to Evaluate Rental Properties

There are many factors to consider when evaluating a prospective rental property. While it largely comes down to a numbers game, there are other factors that are important that math can’t highlight. In this article, we will learn about a few ways to quickly evaluate properties at scale, how I scrutinize a prospective property in greater detail, and list out other important factors that are crucial to building a successful buy-and-hold rental portfolio.

Knowing Your Investment Goal

Before we explore different ways of evaluating rental properties, it’s important to know what your investment goal is. In real estate, some of the most important ones are:

Cash flow: The cash generated by a rental property after expenses for a given time period (e.g. monthly, annually).

ROI (return on investment): A percentage, calculated by summing up a property’s lifetime cash flow, divided by the property’s lifetime costs to own & maintain it.

ROI = Lifetime Cash Flow / Lifetime Costs

Cash-on-cash return: Like ROI, this is a percentage. The difference is that cash-on-cash return is for a given year, whereas ROI is the lifetime return. This is calculated by taking the annual rental income minus expenses, divided by the property’s lifetime costs to own & maintain it.

Cash-on-cash return = Annual Cash Flow / Lifetime Costs

Appreciation: The percentage increase of a home’s market value over time.

Personally, I focus on cash flow and cash-on-cash return. My long-term goal is to buy and hold rental properties to generate enough cash flow to replace my current income.

While cash flow is key for me to attain my goal, I also take into account cash-on-cash return. If I only used cash flow as a metric to evaluate rental properties, then buying cheaper properties (maybe with all-cash) would result in higher cash flow. However, using a ton of cash for just a few properties would limit my ability to expand my rental portfolio and it would result in a lower cash-on-cash return. I prefer leveraging my money with low-interest mortgages to buy more properties and/or more expensive properties. And by leveraging my money, it typically increases my cash-on-cash return. Read why I decided to invest in out-of-state real estate to understand my train of thought in more detail.

Measuring cash-on-cash return also allows me to do an apples-to-apples comparison against other types of investments like stocks, which historically return an average of 8-10% year-over-year. So if a rental property isn’t yielding me a similar return, perhaps it’s best I put my money to work elsewhere.

Lastly, while appreciation is important, it’s not my top priority. Because appreciation isn’t realized until the sale of a property (or a refinance) and because I plan to hold onto my rental properties for many years, I tend to put appreciation on the back burner when I’m initially evaluating a property.

Again, my investment goals may differ from yours, so it’s important to know what yours are and how you plan to use real estate to reach them.

Back-of-the-Envelope Calculations

Many people often wonder how to get started with investing in real estate. One of the first questions to ask is, “How do I find a good one?” First, let’s talk about a couple ways to quickly evaluate a rental property’s cash flow.

1% Rule

The 1% rule says that the monthly rent must be greater than or equal to 1% of the purchase price (including closing costs and repair costs). If it’s not, then the cash flow of the property is insufficient to be a good cash-flowing rental property. Here are a few examples:

For a $100K rental property, 1% would be $1,000 rent per month.

For a $250K rental property, 1% would be $2,500 rent per month.

2% Rule

The 2% rule is identical to the 1% rule, except that the monthly rent must be greater than or equal to 2% of the purchase price (including closing costs and repair costs). So:

For a $100K rental property, 2% would be $2,000 rent per month.

For a $250K rental property, 2% would be $5,000 rent per month.

Personally, I never use the 2% rule. Looking at the 1st example, if I were to pay for this hypothetical $100K property all-cash (no mortgage) and receive $2,000 rent per month, that would mean $24,000 rental income per year. In 4 years (okay, more like 5 years after other expenses), I’d be able to recuperate all the cash I invested. Such a feat seems highly unlikely nowadays. If such a property did exist, I’d be very skeptical and start asking lots of questions like:

How old is the property?

Is it located in a bad neighborhood or near a major intersection/freeway?

Are the schools any good?

Does the property have any damages to it?

Is there a lot of crime in the area?

Cap Rate

Cap rate is another common way to quickly evaluate a property’s rate of return based on the expected income the property will generate. To calculate cap rate, you take the annual cash flow (except the mortgage expense) and divide it by current market value of the property. Here are a few examples:

For a $100K rental property that nets $1,000 rent per month ($12,000 per year), the cap rate would be $12,000 / $100K = 12%

For a $250K rental property that nets $2,500 rent per month ($30,000 per year), the cap rate would be $30,000 / $250K = 12%

In these two examples, you see that the cap rates are identical at 12%. This tells you that investing in either one would yield the same return.

To keep things simple, I think of cap rate as the cash-on-cash return if the property were purchased with all cash (i.e. without a mortgage). Using cap rate is helpful to quickly compare multiple properties & identify which one will yield the highest return. It’s also useful to compare cap rate against other investment opportunities like investing in the stock market.

Personally, I primarily use the 1% rule for quick mental math. Then I examine a property in slightly more detail using cap rate. Lastly, I’ll do a deep dive on the property to see if it’s time to get serious about making an offer.

It’s important to note that these back-of-the-envelope calculations are just rules of thumb. As I mentioned previously, I think the 2% rule is unrealistic; even the 1% rule can be hard to meet nowadays. Just remember that these rules are simply quick ways to gauge a property’s cash flow, but they don’t paint the whole picture. So before you discard a property off your watchlist because they don’t meet one of the rules, be sure to go slightly more in-depth.

Deep Dive Into the Numbers

Before making an offer on a property, it’s key to put the numbers under a magnifying glass. In particular, I’m going to focus on the two objectives most important to me: Cash flow and cash-on-cash return. To calculate those in detail, we need to get organized by first listing out common expenses:

Mortgage

HOA (if applicable)

Property taxes

Insurance

Property management fees

Vacancy factor

Maintenance factor

The last 3 on the list are often overlooked but can make or break a good investment! Property management fees often fall in the 8-10% range of your gross rental income. Vacancy factor is the percentage of the property’s gross rental income that is lost due to vacancies. Finally, the maintenance factor is the percentage of the property’s gross rental income that is lost due to costs to maintain the home.

Now that we have our expenses listed, next we need to list out the types of income:

Rental income, including pet fees

Late fees

Early termination fees

Security deposits (if not returned to the tenant)

There are other items that can be factored into the overall equation, like appreciation and principal paydown. But as I mentioned earlier, my primary objective is neither of those; it’s cash flow and cash-on-cash return. And for now, we’re only concerned about our pre-tax income, which excludes deductions, write-offs, and actual taxes. See my 6 reasons why I invest in real estate article for a list of tax benefits.

To calculate cash flow, simply sum up the income and subtract all expenses. I like to see what this looks like on a monthly and annual basis.

To calculate cash-on-cash return, take the annual cash flow and divide it by the property’s lifetime costs to own & maintain it. On initial purchase, its lifetime costs would only be the down payment and closing costs.

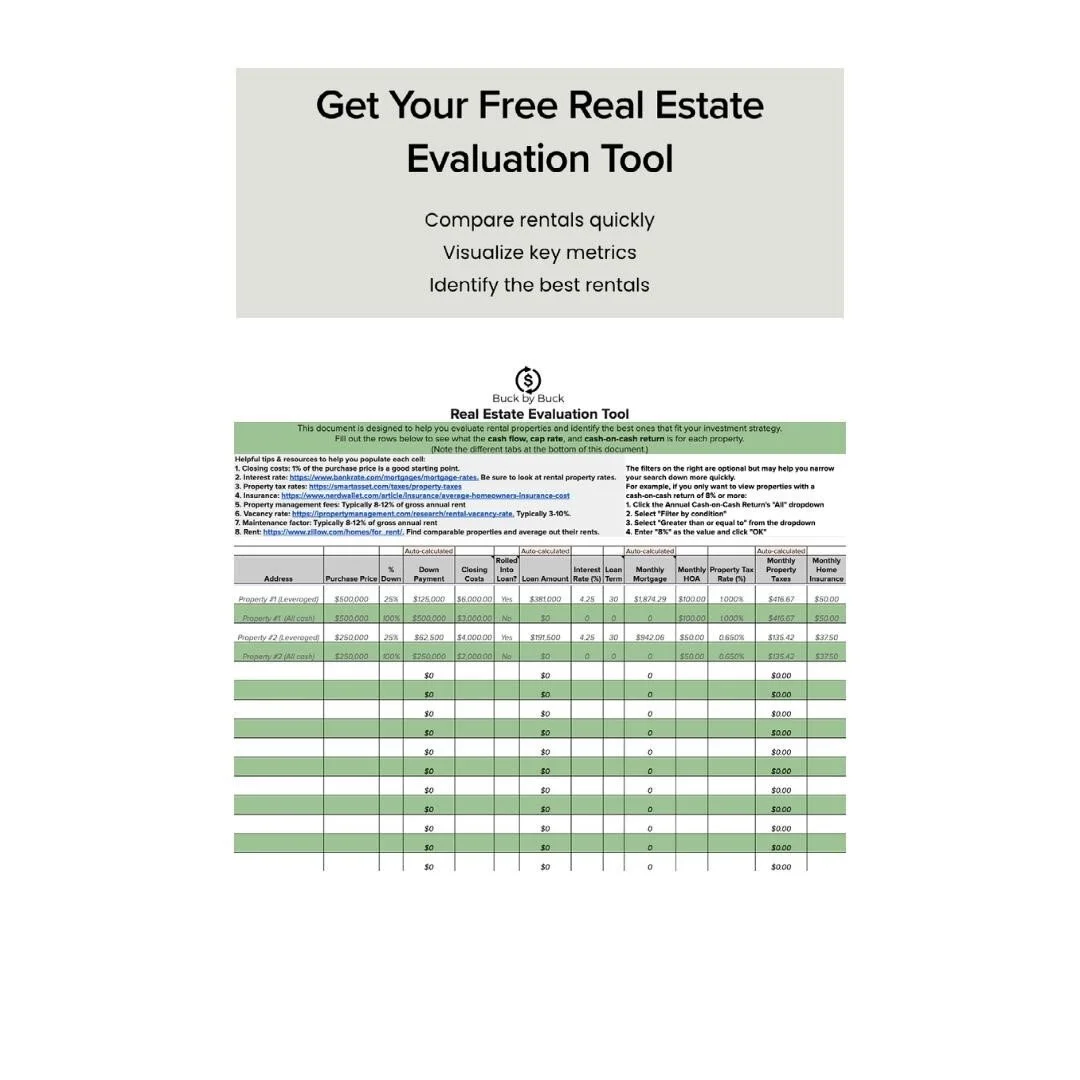

If you’re serious about evaluating properties to start building your own real estate portfolio, sign up for my FREE Real Estate Evaluation Tool by clicking the image below! This tool will help you stay focused on evaluating rental properties using key metrics like cash flow and cash-on-cash return. It comes pre-populated with sample properties with real numbers so you have concrete examples as a reference. Lastly, I’ve included some useful links in my tool that I commonly use to find data about properties I’m analyzing.

5 Factors Not Included in Math Formulas

I’m a big advocate for making data-driven decisions as often as possible. However, some things can’t be quantified with numbers and plugged into a math formula when evaluating a rental property. Here’s my list of unquantifiable factors that are just as critical as solid numbers and can make or break a real estate deal. Every item on this list needs to be researched heavily, in tandem with my FREE Real Estate Evaluation Tool.

Job market: What kind of jobs are held by your future tenants? Are the industries in the area continuing to adapt to the rapidly-evolving economy (think technological advances)?

Demographics: Median household income levels, poverty line, etc. Do you think those income levels will be able to afford your rent? Is the population growing or shrinking? Why, and at what rate? What’s the percentage of renters vs homeowners?

Location: Is the property in a good walkable, bikeable, or commutable distance from nearby schools, restaurants, businesses, parks, airports, etc.? You usually don’t want it to be too close, but also not too far. Is it nearby any landfills that may stink up the air from time-to-time? Is it in a nearby airport’s flight path where your renters will constantly hear planes flying overhead? What kind of natural disasters is this property vulnerable to (floods, earthquakes, hurricanes, etc.)? Is it near a major intersection, road, or freeway?

Schools: Great, mediocre, or bad? On a scale from 1 to 10, I aim for properties that are in the 6 to 8 range. Solid schools usually means safer neighborhoods, less crime, higher levels of education, and a higher rate of appreciation since people will want to keep buying in these zip codes.

Crime: Less crime in the area means safer neighborhoods, which means a more valuable property.

Conclusion

To summarize, we learned about a few different ways to quickly evaluate properties at scale using the 1% rule, 2% rule, and cap rate, how to calculate cash flow and cash-on-cash return using my FREE Real Estate Evaluation Tool, and other important unquantifiable factors that are also crucial to building a successful buy-and-hold rental portfolio.

If you have any questions related to getting started with real estate investing, comment below or reach out to me directly. As always, subscribe to my newsletter and follow me on Instagram @buckbybuckblog so you don’t miss out on my weekly blog posts and future investing tools and guides!